The requirement for personalization is huge, and personal care companies are among the first in FMCGto take note. For about 5 years, ever since direct to consumer e-commerce became wide-spread in the US (and long before that in China), beauty and toiletry manufacturers have been experimenting with custom-made products.

US personal care sales are expected to reach $134.2 billion by 2025 according to Grand View Research. And, according to Schieber Research, growth drivers include natural/vegan products, personalization, rituals/mindfulness, and stress-free/ convenience.

Many of these compete in the Indie/ premium segment, and industry leaders are trying to compete by investing in loyalty clubs and premiumization led by science, whereas smaller competitors are upping their game in social commerce, direct to consumer and tailor-made products.

Here’s an example – Prose, a NYC based brand with $25 million in funding (Crunchbase), was founded in 2017 to design “haircare for the individual”. It looks like the company’s main focus is influencers, bloggers and social media, especially Instagram, where it advertises its great reviews.

As mandated in similar personalized customer journeys (including in the fashion, food and beverage, and supplements), the shopper first completes a holistic and thorough questionnaire investigating her/his lifestyle, hairstyle, hair-aspirations and worldly limitations. Then, a plan is tailored to the customer and he/she is prompted to subscribe (along with an army of retargeting and email marketing ads). Upon subscribing, the customer’s order is prepared and the subscriber gets a package with the products recommended to her/him according to the questionnaire.

This year, due to the pandemic benefitting upscale beauty and direct to consumer sales, the company tripled its revenue YoY to reach approximately $50 million.

Judging by the high Alexa ranking (the website ranks 11,000 in the US – to compare with better known direct to consumer brands, Unilever owned Dollar Shave Club ranks at 4000 and Glossier 2,350) – it seems like the demand of at least interest in this type of value offering is high, considering a price point of $25 for 1 bottle of shampoo.

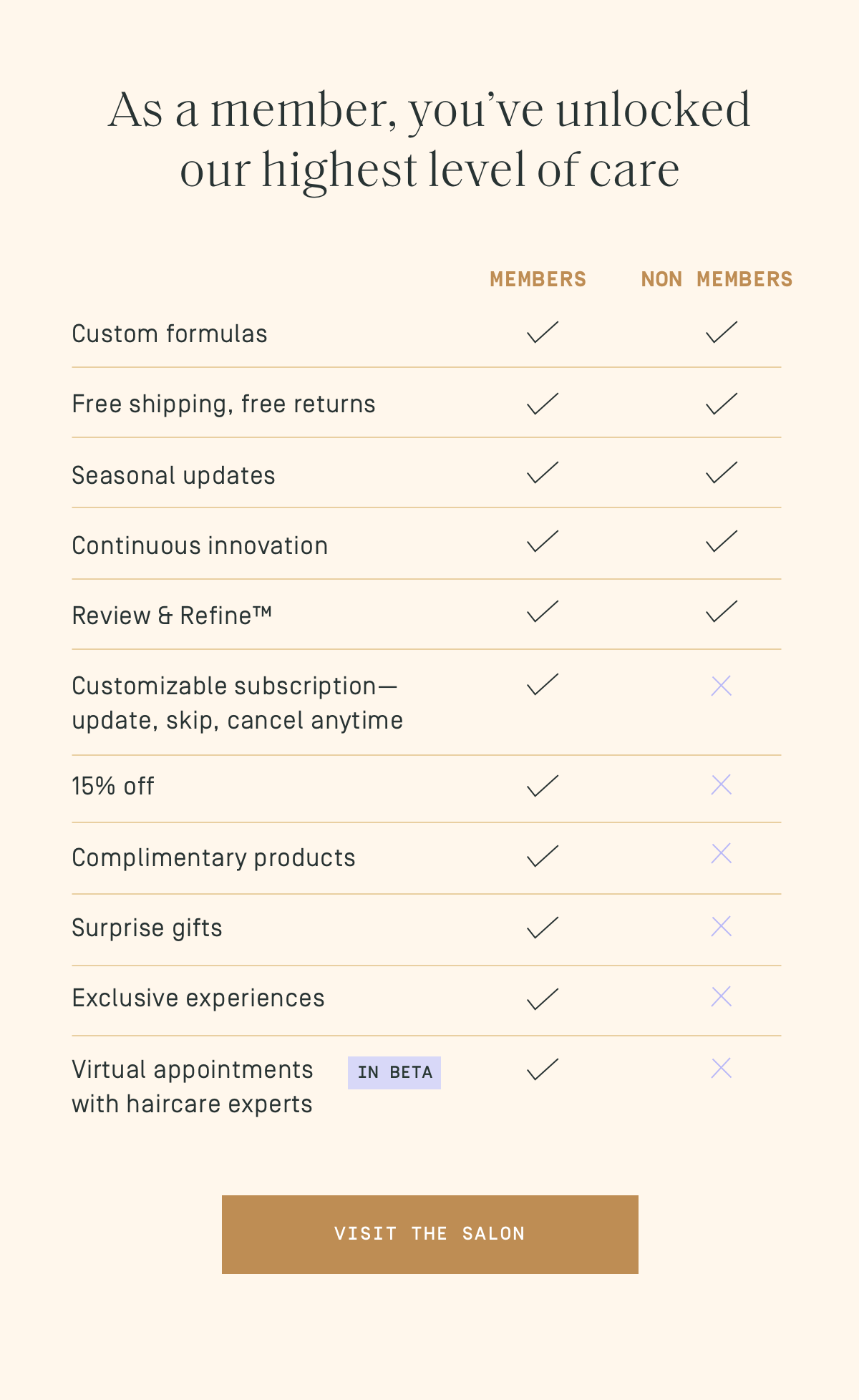

To add value beyond the product, the company uses content marketing to become more of a lifestyle brand – positioned as a club membership (the Salon), and offering rewards for loyalty.

This type of program is crucial for today’s brands – emerging or mature: consumers are faced with a huge variety of brands at the tip of their fingers, and rewarding them for repeat purchase is always cheaper than acquiring new consumers.

This type of program is crucial for today’s brands – emerging or mature: consumers are faced with a huge variety of brands at the tip of their fingers, and rewarding them for repeat purchase is always cheaper than acquiring new consumers.It also caters to the need for “Concierge” – appealing to consumers as self-care and stress-free solutions.

Side Note To the lifestyle brands prompting a questionnaire bordering on psychoanalysis, from Prose to AdoreMe to Lola, please remember there's no harm in using this Mary Poppins ruler in the results.Thank you.